Hi, what are you looking for?

Trade Ideas

Although there is no such thing as a 100 percent safe bet in the world of trading, there are 10 things that you can...

Trade Ideas

If you’re interested in investing as a beginner for the first time or expanding your portfolio, here are some effective steps to reduce investment...

Trade Ideas

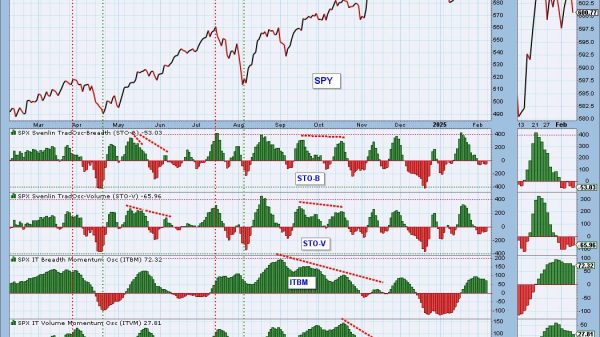

This is the market-timer’s dilemma in real time – trying to outguess short-term moves instead of sticking with a long-term, risk-appropriate plan. This week’s...

Trade Ideas

In this article, I’ll introduce Monte Carlo simulations, explain their relevance in trading, and describe a specific options trading strategy I’ve developed using these...

Trade Ideas

As is always the case, though, there is some flipside to that risk. When they go well, crypto trades enjoy benefits including the potential...

Trade Ideas

Figure 1 TLRY iron fly on 13 September 2018 Options have infinite combinations but the classic hypothetical risk free trade is the credit spread...

Trade Ideas

Covered calls are popular among investors looking for a conservative way to generate additional income from their stock holdings. However, it’s essential to understand...

Trade Ideas

What’s the Difference Between SPX and SPY Options? Dividends Dividends are not normally paid to options holders. However, SPY pays a dividend every quarter....

Trade Ideas

A few weeks ago we introduced a new strategy to our members. While a double diagonal spread is a well known strategy, we are...

Trade Ideas

This article will shows how this works, and how IV can affect your decision on what type of trade to open. Directional Spreads Let’s...

Trade Ideas

Insider Buying and Selling In doing so we are competing with quant-based analysis that is poring hundreds of millions of dollars into similar things...

Trade Ideas

Ratio trading the earnings Everyone knows what a ratio trade is right? A ratio can be found in many shapes, forms and directions, the...

Trade Ideas

Performance Dissected Check out the Performance page to see the full results. Please note that those results are based on real fills, not hypothetical...