Stock markets struggled overnight. Mainland China bourses found buyers, but JPN225 and ASX declined, as markets watched developments in the Middle East. Risk sentiment improved during the start of the week as Israel seemed to be moving with more caution than anticipated, which helped to dampen concern about a widening of the conflict. Stock futures are higher across Europe and the US and the 10-year treasury yield has lifted 2.6 bp to 4.86%, with oil and gold also declining as haven flows ease. Treasuries were boosted also after the slowing in the PCE deflators underpinned expectations the FOMC is on hold. Short covering and a flight to safety extended the more bullish tone as Israel began its ground assault on Gaza.

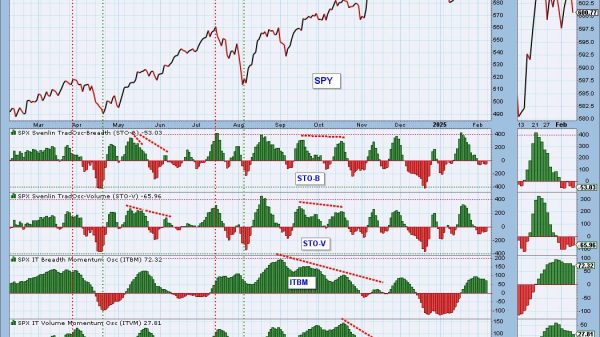

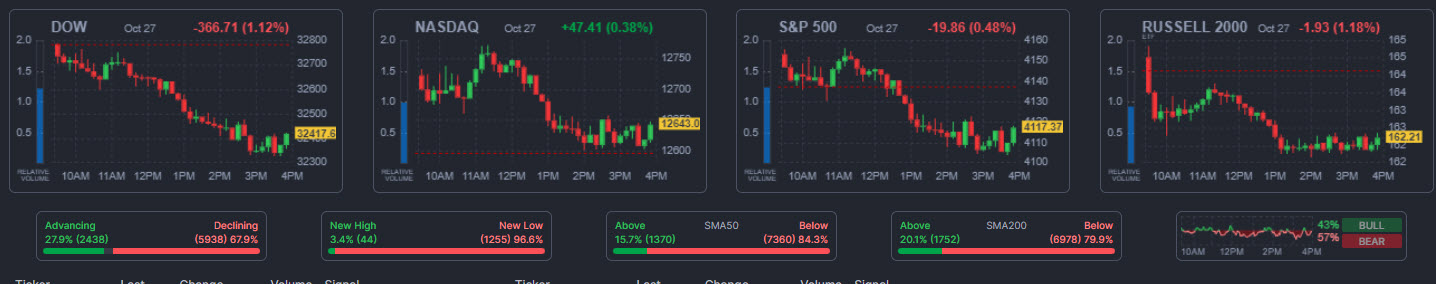

Stock markets slightly higher today after Wall Street saw the US30 drop -1.12% with a hefty -6.7% plunge in the energy complex. The US500 declined another -0.48%, with the latter now in correction territory, -10.3% below the July 31 peak. The US100 bounced 0.38%. For the 5 days, the US30, US500, and US100 are down -2.14%, -2.53%, and -2.62%, respectively. Morgan Stanley’s Wilson: ‘‘Chances of a fourth-quarter rally have fallen considerably”,“Narrowing breadth, cautious factor leadership, falling earnings revisions and fading consumer and business confidence tell a different story than the consensus, which sees a rally into year-end.” Amazon’s pop by 6.8% and Intel’s jump by 9.3% helped soften the blows from big drops in Alphabet, Meta, and Tesla. Ford stumbled 12.2%. JGB yields climbed to fresh 10-year peaks today & USDJPY corrected to 149.22, as investors weighed the chances of a possible policy tweak in the BOJ’s monetary policy decision tomorrow. BOJ is widely expected to keep its short-term rate target at -0.1% and that target for long-term rates around 0% as set under its YCC policy. USDIndex is at 106.50, down on Friday’s close, but within the previous day’s range. GOLD spiked to $2006.40 on the escalation of the war. Currently settled lower at $1990. It’s likely to continue benefiting should tensions increase, alongside the Swiss franc and short-dated US government bonds. USOIL lower at $83.70.Today: Central bank meetings: FED, BOE and BOJ. Earnings: Apple, Airbnb, McDonald’s, Moderna and Eli Lilly & Co among the many reporting this week.

Interesting Mover: USDCHF broke descending channel and extends higher for a 4th day in a row.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.