Stock market sentiment improved, and Asian equities bounced, alongside gains in European and US futures. Earnings reports helped tech stocks to stabilise, ahead of more key US data. The 10-year Treasury yield is up 3.2 bp at 4.88%, after strong GDP numbers yesterday. Eurozone bonds meanwhile continued to find buyers, after the ECB effectively confirmed yesterday that in the central scenario rates have peaked. The schedule for the re-investment of PEPP redemptions was also left untouched, which helped peripherals to outperform and spreads to come in. US economy expanded at its quickest pace in almost 2 years in the latest sign of the country’s economic resilience.

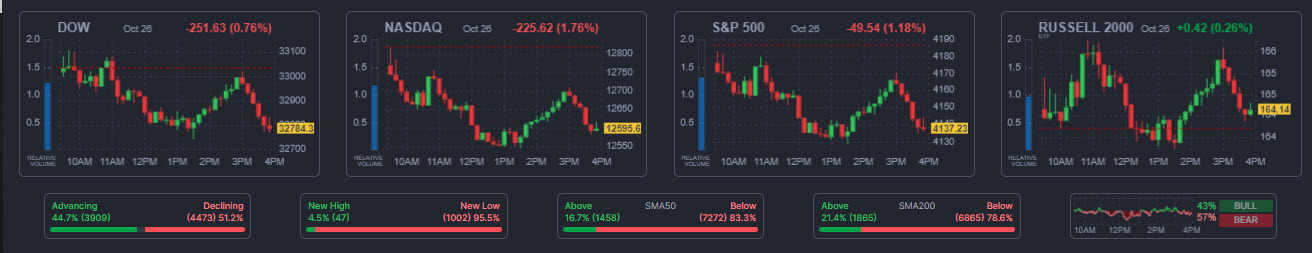

Stock markets: Wall Street close in red for a 2nd session. The US100 has cratered -2.05%. The US500 has dropped -1.28% and is -3.2% lower, with the US30 down -0.77% today and -1.9%. Over the past 5 sessions the indexes are posting declines of -4.75%, -3.2%, and -1.9%, respectively. Today, stock sentiment improved. Asian shares rose after strong Q3 sales at Amazon helped drive a recovery in investor sentiment following weak results from other technology groups earlier in the week. Amazon (+5.36% after hours) sees best profits since 2021. Meta (+0.95% after hours) ad revenue (+23%) fuels blowout Q3, $11.6 billion in profits. Elon Musk just lost $28 billion as Tesla (+1.25% after hours) took a beating. USDIndex has lost altitude slightly to 106.36 after climbing to 106.894, just shy of the 107.000 level from October 3 that was the highest since late 2022. USDJPY is holding the 150.00 level, continuing to test the MoF after finance minister Suzuki warned that authorities were closely watching currency moves “with a sense of urgency.” EURUSD lost ground on the ECB’s stance, trading at 1.0544, though inside the day’s 1.0574 to 1.0524 range. USDCAD remains above at 1.3810 after the BoC’s announcement . GOLD flat but close to 1998 (more than 2-months highs). USOIL recovered to $85 after a fall due to a rise in US crude stockpiles and a climb in the US Dollar.Today: US PCE deflator, personal consumption, University of Michigan sentiment (October), Exxon, Chevron earnings.

Interesting Mover: USDCHF broke descending channel and extends higher for a 4th day in a row.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.